Medicare Part B Premiums Based On Income 2024 Ny

Whether you sign up for original medicare (medicare parts a and part b, run by the federal government) or medicare advantage (part c, run by insurance. The annual deductible for all medicare part b.

Costs for part b (medical insurance) get help with part a & part b costs. In 2024, the irmaa for single taxpayers with incomes greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for joint.

It Also Covers Other Medical Services, Such As Physical And Occupational Therapy, And Some Home Health Care.

In 2024, the irmaa for single taxpayers with incomes greater than $103,000 and less than or equal to $129,000 (between $206,000 and $258,000 for joint.

The Standard Monthly Premium For Medicare Part B Enrollees Will Be $174.70 For 2024, An Increase Of $9.80 From $164.90 In 2023.

Agi can affect your eligibility to itemize deductions on your tax return, as certain deductions are subject to agi limitations.;

Images References :

Source: imagetou.com

Source: imagetou.com

What Is The 2024 Medicare Premium Part B Image to u, Additionally, the annual deductible for medicare part b beneficiaries will go up from $226. Part b helps pay for your doctors’ services and outpatient care.

Source: jessicahayes.z13.web.core.windows.net

Source: jessicahayes.z13.web.core.windows.net

Medicare Part B Premium 2024 Chart Pdf, For example, in 2023, individuals with an annual income of $97,000 or. In 2024, the part b deductible is $240.

Source: www.medicaretalk.net

Source: www.medicaretalk.net

What Is Used For Medicare Part B Premiums, Irmaa is a surcharge added to your medicare parts b and d premiums,. What are the medicare income limits in 2024?

Source: mariannwrubi.pages.dev

Source: mariannwrubi.pages.dev

Medicare Part B Premium 2024 Chart Based On Mona Sylvia, The centers for medicare & medicaid services (cms) released the 2024 premiums, deductibles, and coinsurance amounts for the medicare part a and part b programs,. For example, in 2023, individuals with an annual income of $97,000 or.

Source: www.world-today-news.com

Source: www.world-today-news.com

2024 Medicare Part B Premiums Cost Increase and Rates, The annual deductible for all medicare part b. If you have limited income and resources, you may be able to get help from your state to pay your.

Source: remyqjacquetta.pages.dev

Source: remyqjacquetta.pages.dev

Limits For Medicare Premiums 2024 Fifi Katusha, Typically, after you reach your $240 deductible for the year, you are required to pay 20% of medicare part b approved. Part b premiums will increase by $9.80 from $164.90 to $174.70 in 2024.

Original Medicare Benefits 2024 Lulu Sisely, Medicare part b premium reimbursement faqs. It also covers other medical services, such as physical and occupational therapy, and some home health care.

Source: trixiarozele.pages.dev

Source: trixiarozele.pages.dev

2024 Limits For Medicare Premiums June Sallee, The standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. Most people will pay the standard part b premium.

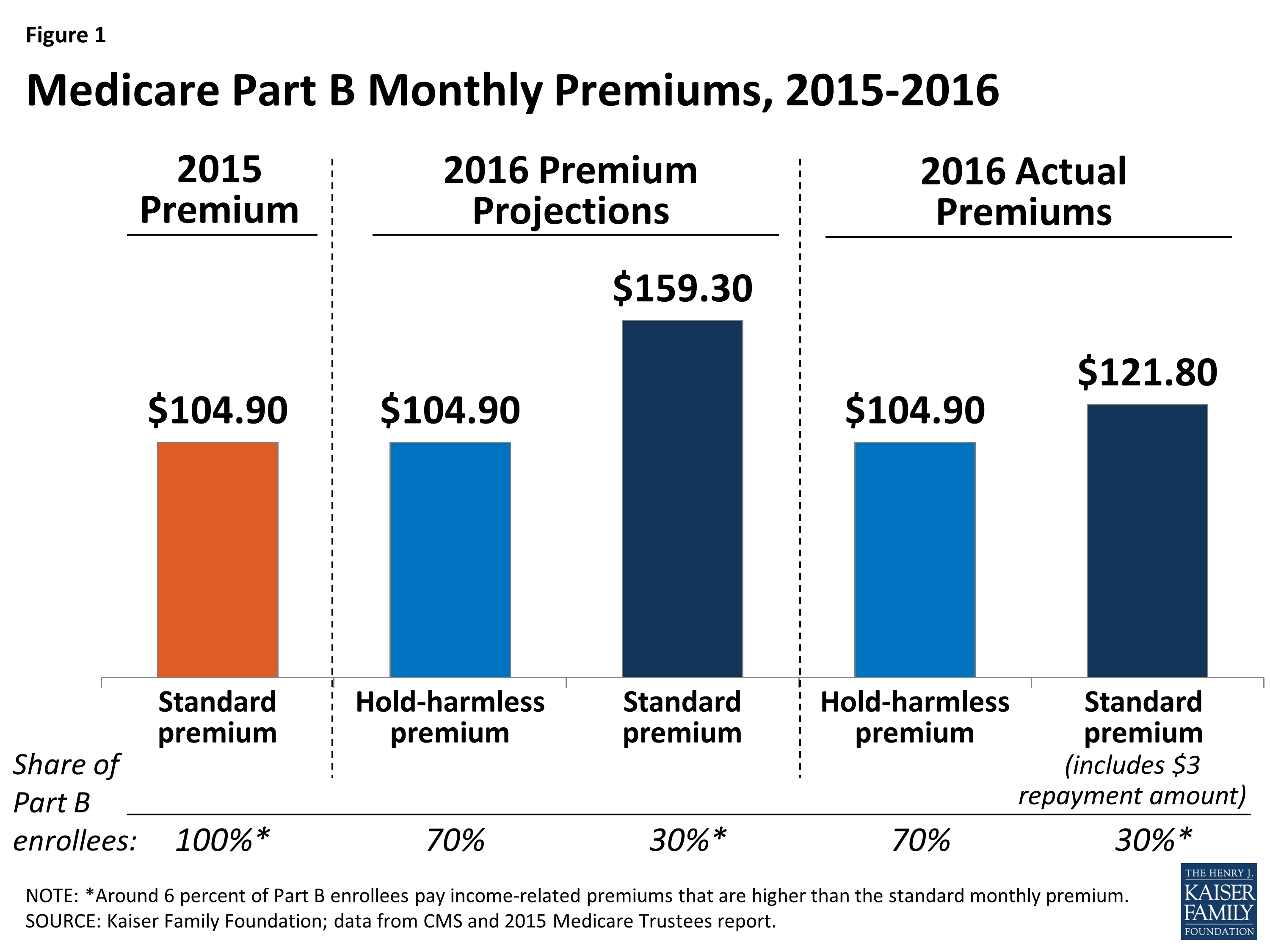

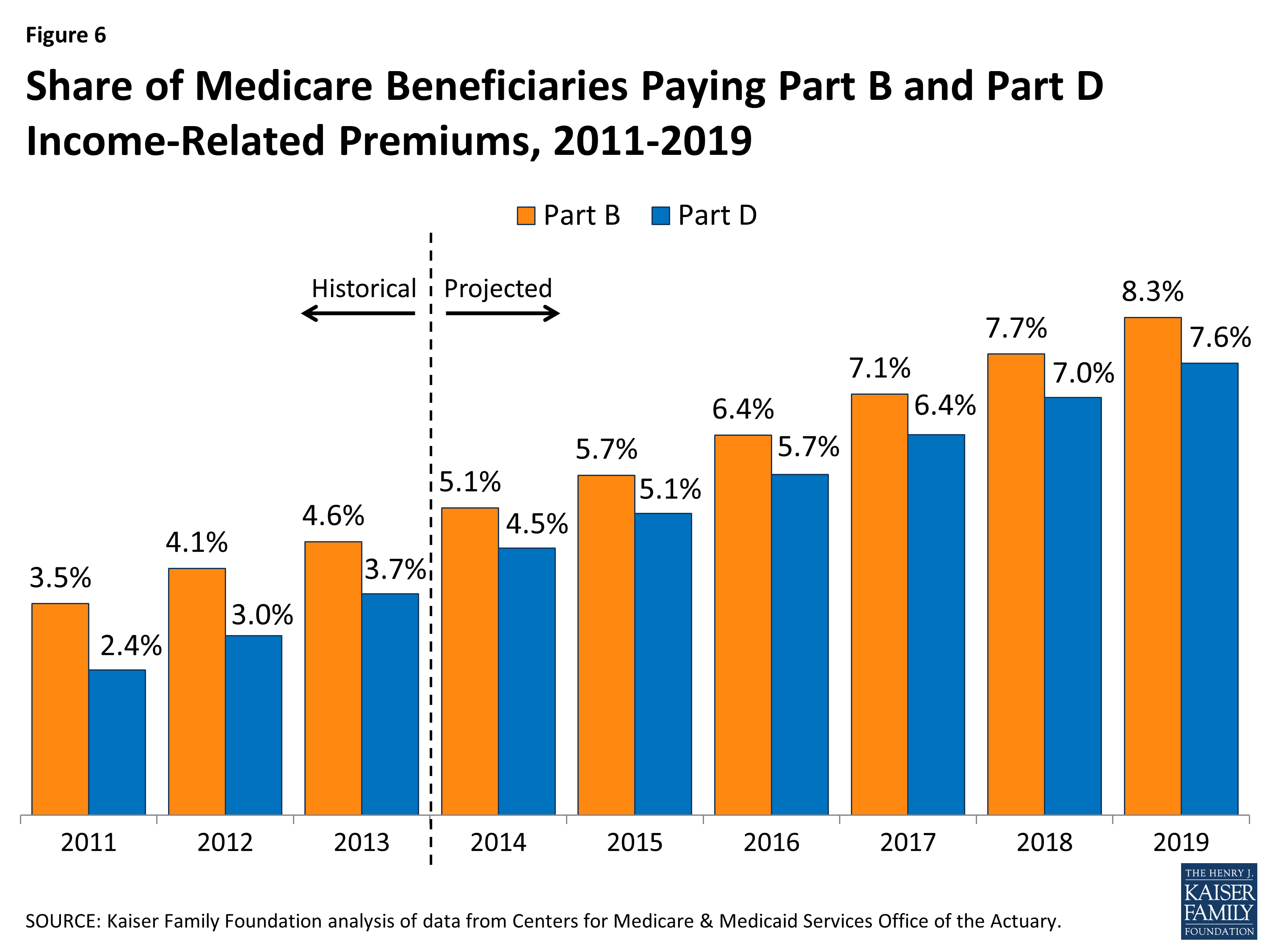

Source: www.kff.org

Source: www.kff.org

Medicare's Premiums A Data Note KFF, Medicare part b premium reimbursement faqs. For example, you would qualify.

Source: www.kff.org

Source: www.kff.org

Medicare's Premiums A Data Note KFF, The standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023. The standard monthly premium for medicare part b enrollees will be $174.70 for 2024, an increase of $9.80 from $164.90 in 2023.

Agi Can Affect Your Eligibility To Itemize Deductions On Your Tax Return, As Certain Deductions Are Subject To Agi Limitations.;

What are the medicare income limits in 2024?

The Standard Monthly Premium For Medicare Part B Enrollees Will Be $174.70 For 2024, An Increase Of $9.80 From $164.90 In 2023.

Some medicare beneficiaries may pay more or less per month for their part b.